The Century Report: February 8, 2026

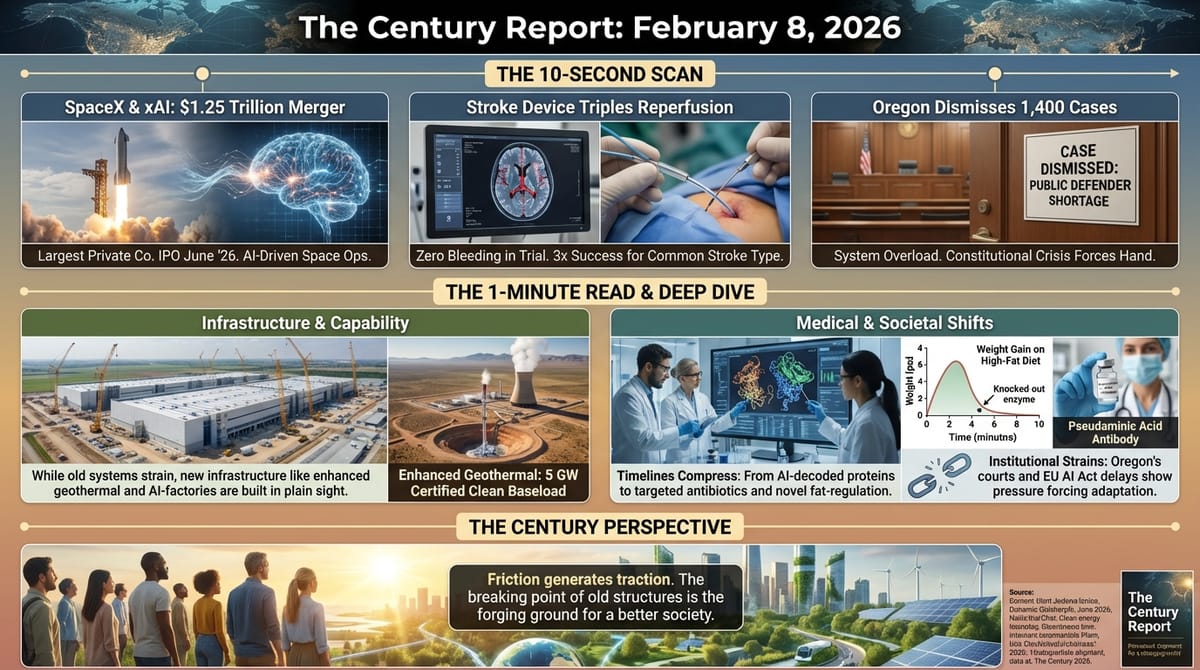

The 10-Second Scan

- A stroke device tripled reperfusion rates for ischemic strokes that had no proven treatment.

- Oregon's Supreme Court dismissed 1,400 criminal cases over a shortage of public defenders.

- A company is spending $1,000/engineer/day on AI tokens to write all production code without human review.

- A newly discovered fat-production enzyme stopped weight gain entirely when knocked out in mice.

- SpaceX acquired xAI to form a $1.25 trillion company with an IPO planned for June.

- Enhanced geothermal received its first independent reserves certification - 5 GW of clean baseload under Utah.

The 1-Minute Read

Each of today's headlines reveals something structural: capability is expanding faster than the systems designed to manage it can adapt.

Today's signals split into two clear patterns. On one side, interventions that were impossible last year are now proven - a stroke treatment tripling effectiveness, a metabolic pathway identified and silenced, clean baseload energy independently verified at scale. On the other, institutions are buckling under the pace - a state legal system collapsing under its own caseload, regulatory frameworks arriving late, labor data about to be revised by 650,000 jobs.

This is the signature of a system in mid-transition: new capabilities emerging faster and faster, with old structures bending under the weight of change. The friction is the evidence that something fundamental is shifting.

The 10-Minute Deep Dive

The $1.25 Trillion Merger and the Consolidation of Capability

SpaceX's acquisition of xAI, announced February 2 and still generating analysis through this weekend, created a combined entity valued at $1.25 trillion - SpaceX at $1 trillion, xAI at $250 billion. An IPO is planned for June 2026, timed to coincide with a planetary alignment and Elon Musk's birthday. The Guardian and Bloomberg have both questioned whether the premise behind the deal will bear out, but the structural fact is undeniable: the company that dominates orbital launch, satellite broadband (9,600+ Starlink satellites), and heavy-lift spaceflight now also controls a major AI lab. The stated ambition is to extend AI capabilities into space operations, though skeptics note xAI's Grok chatbot has not demonstrated the same frontier performance as competitors from OpenAI and Anthropic.

This consolidation arrives alongside a broader pattern. As The Century Report covered yesterday, Big Tech committed roughly $650 billion to AI infrastructure for 2026. Updated figures from this week's earnings disclosures push the combined total from Amazon, Alphabet, Meta, and Microsoft closer to $700 billion, a 60% increase over 2025. Nvidia stock rebounded 7.8% on Friday after CEO Jensen Huang called spending levels "appropriate and sustainable." Investors were less convinced - the four companies shed a combined $950 billion in market cap during the week. The Washington Post reported the spending is creating real-economy ripple effects: shortages in skilled electricians, data center construction outbidding housing and healthcare projects for labor, and an estimated 500,000 new construction workers needed in 2026 alone.

The Labor Data of a Shifting System

Building on the January layoffs data The Century Report covered on February 6, new signals this week paint a more complete picture. The upcoming January jobs report, delayed to February 11 by a partial government shutdown, will include a benchmark revision expected to erase roughly 650,000 jobs from the official payroll level for March 2025. ADP's private sector report showed only 22,000 jobs added in January, well below expectations, with manufacturing declining for 22 consecutive months. December JOLTS data revealed job openings falling to 6.54 million - their lowest level since September 2020 - with professional and business services openings down 21.8% since October.

Fed Vice Chair Philip Jefferson offered a new framing on February 6 that deserves attention: the labor market is in a "low-hiring, low-firing" equilibrium, but AI-related capital investment could temporarily elevate inflation even as it raises productivity. This is a temporal mismatch argument - massive AI infrastructure spending adds demand-side pressure now, while productivity gains materialize later. If the Fed holds rates higher for longer as a result, the very investments meant to transform the economy could constrain it in the near term.

Meanwhile, the corporate restructuring wave continues. Block (Jack Dorsey's fintech company) is cutting up to 10% of its workforce - its second major reduction in under a year - while redirecting resources toward its AI tool "Goose." Workday cut 400 positions and took $135 million in charges, including $80 million in office space impairment, a signal of permanent physical footprint reduction. A Reuters compilation of 2026 layoffs shows AI being invoked across radically different sectors: chemicals (Dow, 4,500), social media (Pinterest, 780), fintech (Block, 1,100), and enterprise software (Workday, 400). The Challenger data puts AI-cited layoffs at 7% of January's total, but the broader story is anticipatory restructuring at scale.

One counterpoint worth noting: Bank of America's internal data showed private payroll growth rebounding modestly to 0.8% year-over-year in January, up from 0.6% in December, with unemployment payment growth dipping below 10% for the first time since July 2025. The picture is not uniformly bleak, even for the short-term. But the income gap between high and low earners continues to widen, consistent with a pattern where productivity gains accrue unevenly - a structural feature of transitions, not a temporary glitch. The macro view here is that the labor market is reconfiguring. Companies are not firing everyone - they are repositioning around fundamentally different assumptions about what work requires a human. The pain is real and concentrated in specific populations, but the direction of travel is toward an economy that produces more with different inputs, and the policy question is how quickly society can adapt its support structures to match.

The Geothermal Breakthrough Hiding in Plain Sight

While AI infrastructure spending dominates headlines, one of the most significant energy developments of the year has received far less attention. The Proceedings of the National Academy of Sciences published new analysis this week projecting enhanced geothermal system (EGS) costs will fall below $70 per megawatt-hour by 2030. Fervo Energy's Cape Station project in Utah - the world's largest EGS under construction at 500 MW - received an independent reserves report from DeGolyer & MacNaughton, an oil and gas auditing firm, confirming the site can support over 5 GW of development. Fervo has assembled acreage for up to 10 GW.

These numbers matter because they address the single biggest infrastructure question of 2026: where does the baseload power come from? As mentioned in yesterday's The Century Report, data center demand is projected to add 90 GW of peak load growth through 2030, and 92% of operators cite grid constraints as their primary barrier. The largest permitted power project in the U.S. - a 7.65 GW gas-fired facility in West Texas - illustrates the scale of the problem. A nearly $4 billion combined-cycle gas plant was just contracted in North Dakota for the same reason.

Enhanced geothermal offers something different: 24/7 carbon-free baseload power with a land footprint nine times smaller than solar or wind, modular 50 MW units that can be permitted and built in under four years, and a resource base the DOE estimates at 90 GW by 2050. Fervo's thermal recovery factor of 50-60% is three times conventional geothermal. The first 90-100 MW phase targets delivery this year, with 400 MW contracted for 2028 through power purchase agreements with Southern California Edison and Shell Energy. This is the clean, firm power backbone that grid planners have been looking for, and it's emerging from techniques borrowed from the oil and gas industry - horizontal drilling and hydraulic fracturing applied to hot rock rather than fossil fuel extraction. The irony is fitting: the tools that built the old energy system are now being repurposed to build the new one.

Medical Timelines Continue to Compress

Several medical developments this week demonstrate the same pattern of timeline compression that has characterized this transition period. At the International Stroke Conference, Rapid Medical presented results from the DISTALS trial showing its TIGERTRIEVER 13 device achieved 86.3% successful brain tissue reperfusion in medium vessel occlusion strokes, compared to 27.7% for medical management alone, with zero symptomatic hemorrhage in the device arm. Medium vessel occlusions account for roughly half of all ischemic strokes and have had no proven thrombectomy treatment in randomized trials. This is not an incremental improvement - it's a 3x treatment effect in a population that had no randomized evidence for intervention.

At ACTRIMS Forum, Roche presented Phase III data showing fenebrutinib, the first oral brain-penetrant BTK inhibitor, met its primary endpoint in primary progressive MS - a disease with only one approved therapy since 2017. Researchers at Case Western Reserve discovered a previously unknown enzyme called SCoR2 that controls fat production by removing nitric oxide from lipogenic proteins. When knocked out in mice, animals showed zero weight gain on high-fat diets - a mechanistically novel pathway distinct from GLP-1 agonists. And at the University of Sydney, researchers engineered an antibody targeting a sugar produced exclusively by bacteria - pseudaminic acid - that cleared lethal drug-resistant infections in mice. Because humans don't produce this sugar, the approach offers a specificity that traditional antibiotics cannot match, with a five-year translational timeline targeting ESKAPE pathogens.

Meanwhile, King's College London researchers used AlphaFold3 to decode the molecular mechanism behind spider silk's extraordinary strength, identifying specific amino acid "stickers" that trigger protein assembly. This is AI-accelerated materials science producing fundamental insights that had eluded researchers for decades. The distance between AI prediction and laboratory validation continues to shrink, and each instance makes the next one faster.

When Systems Can't Keep Up

Oregon's Supreme Court ruling - ordering dismissal of 1,400+ criminal cases because the state cannot provide constitutionally mandated legal representation within 60 days for misdemeanors and 90 days for felonies - is a different kind of signal. Institutional capacity is failing to meet existing obligations. Hundreds of defendants waited more than a year without counsel. The state's recriminalization of drug possession in 2024 flooded courts with new cases that a system already running on fumes couldn't absorb.

This sits alongside a broader institutional stress pattern. The EU AI Act's Article 6 high-risk classification guidelines were due February 2, with full enforcement powers activating in August - and 18 member states have already failed to transpose related directives. The DOJ and 38 states are appealing the Google search antitrust remedies ruling, while Google cross-appeals the liability finding, ensuring years of further proceedings in a market that has already been restructured by generative AI. The Moltbook data breach - the AI agent social network The Century Report covered on February 6 now confirmed to have exposed real human data and 1.5 million API keys - illustrates what happens when infrastructure moves faster than the security practices meant to protect it.

These institutional gaps are not permanent. They are the growing pains of systems that were designed for a slower world being asked to function in a faster one. Oregon's ruling, for instance, does more than expose a problem - it forces a solution by creating a binding mechanism that makes inadequate funding unsustainable. The EU's enforcement apparatus, for all its delays, is building regulatory infrastructure at a scale no other jurisdiction has attempted. The antitrust proceedings reflect a system still trying to apply old categories to new realities - and that tension itself is part of the transition. The path through institutional strain runs toward institutional adaptation, and the pressure is what drives the adaptation.

The Human Voice

This week's newsletter features a company where AI writes all production code without human review. For a grounded take on what that trajectory actually means, Nathan Lambert (post-training lead at the Allen Institute for AI) and Sebastian Raschka (ML researcher and author of Build a Large Language Model From Scratch) sat down with Lex Fridman on February 1 for a deep technical conversation about where AI capabilities actually stand. Both are working researchers, not executives, and they bring the kind of nuance that headlines strip away - Lambert estimates 90% automation of routine programming is imminent, but argues the human role shifts toward verification and high-level design rather than disappearing. Their discussion of agentic coding, scaling laws, and what "replacement" actually looks like in practice adds depth to the labor restructuring signal this newsletter has been tracking all week.

Watch: State of AI in 2026 - Nathan Lambert & Sebastian Raschka (Lex Fridman Podcast #490)

The Century Perspective

With a century of change unfolding in a decade, a single day looks like this: geothermal reserves independently certified at 5 GW under a single Utah site, a stroke device tripling treatment effectiveness for half of all ischemic strokes, a hidden fat enzyme identified and silenced, spider silk decoded through AI-driven structural modeling, orbital launch and artificial intelligence merging into a single entity, and AI systems now writing production code autonomously. There's also friction, and it's intense - 650,000 phantom jobs about to vanish from official records in a benchmark revision, manufacturing declining for 22 straight months, a state court dismissing 1,400 cases because the legal system ran out of lawyers, AI agent platforms breaching the data of the humans they were built for. But friction generates momentum, and momentum is what carries a transition past the point where it can be reversed. Step back for a moment and you can see it: the energy backbone being rebuilt with tools borrowed from the old system, medical interventions crossing from impossible to proven in single trials, the distance between hypothesis and validated discovery shrinking with each iteration, institutional structures cracking precisely where they need to be rebuilt. Every transformation has a breaking point. A current can drown what stands against it... or carry everything it touches somewhere entirely new.

Sources

AI & Technology

- CNBC: SpaceX-xAI Merger at $1.25 Trillion

- The Guardian: Why Has Musk Merged SpaceX with xAI?

- Simon Willison: StrongDM Software Factory

- WIRED: Moltbook Data Breach

- Wiz: Moltbook Database Exposes 1.5M API Keys

Labor & Economic Transformation

- Reuters: Block Cutting Up to 10% of Staff

- Reuters: US Job Openings Drop to Five-Year Low

- Reuters: Fed's Jefferson on Economy and Labor

- Boston Globe: Jobs Report and Benchmark Revision Preview

- Reuters: Corporate America 2026 Layoffs Factbox

- Bank of America Institute: January 2026 Employment Report

Energy & Infrastructure

- PNAS: Enhanced Geothermal Cost Projections

- Fervo Energy: Cape Station and Reserves Report

- Construction Dive: PCL Wins $4B Bison Generation Station

- Data Center Knowledge: Grid Strain Reaches Critical Phase

- NYT: Gateway Tunnel Funding Restored by Court Order

Scientific & Medical Acceleration

- Rapid Medical: DISTALS Trial Results

- Roche: Fenebrutinib Phase III FENtrepid Data

- ScienceDaily: SCoR2 Fat-Production Enzyme Discovery

- University of Sydney: Antibody Targeting Bacteria-Only Sugar

- ScienceDaily: Spider Silk Molecular Stickers via AlphaFold3

- University of Edinburgh: Complete CTNNB1 Mutation Map (Nature Genetics)

Institutional & Regulatory

- The Guardian: Oregon Supreme Court Orders 1,400+ Case Dismissals

- Marquette Law School: 63% Want SCOTUS to Limit Tariff Authority

- White House: India Tariff Modification Executive Order

The Century Report tracks structural shifts during the transition between eras. It is produced daily as a perceptual alignment tool - not prediction, not persuasion, just pattern recognition for people paying attention.